SHI Insights – The impact of the 2026 memory shortage on data center buyers:

Strategic guidance for technology leaders and buyers

Executive summary

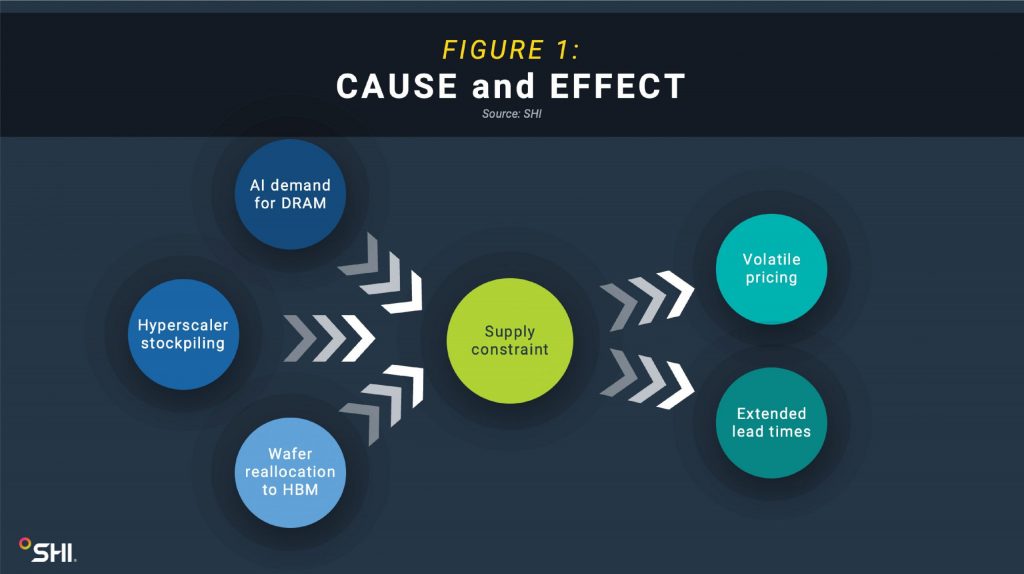

The 2026 memory shortage is creating challenges for IT and procurement teams as they plan for critical server deployments in 2026. A combination of AI-driven DRAM demand, hyperscaler stockpiling, and wafer capacity reallocation to high-bandwidth memory (HBM) is driving extreme price volatility and extended lead times.

This article provides insights to help IT leaders mitigate the impact of the memory shortage while maintaining alignment with strategic infrastructure goals. IT and procurement leaders must understand the supply chain dynamics behind the shortage and adopt strategies that align their workloads to the realities of DRAM availability.

Many organizations, particularly those with fiscal years ending in June, face unique challenges in budget planning due to peak pricing early in 2026 and potential supply softening in the second half of the year. By taking decisive action now, IT leaders can reduce the impact of the crisis and ensure continuity for critical projects.

Strategic implications

For technology buyers, the first half of 2026 will see the highest risk of paying premium prices. If deployments are not urgent, phased or deferred buying into H2 is likely to yield better value unless project deadlines are absolutely fixed. IT leadership should budget for a 30-60% price uplift over the January baseline in H1, with the best-case scenario being price stabilization in the second half of the year. Prioritization is critical, as only the most urgent, high-priority projects will be able to justify higher memory prices in H1.

What’s the impact of the memory shortage?

With so much information circulating about the current memory crisis, IT organizations may struggle to evaluate their risk exposure and develop effective risk mitigation plans. Take heed of how memory shortages impact these key areas.

Excessive price increases driven by increased demand: Memory pricing spiked in Q4 2025 due to hyperscaler stockpiling and demand pull-forward for AI and general-purpose workloads. Pricing exceeded forecast levels, creating ripple effects for technology buyers which are resulting in continued price increases into 2026.

Extended lead times threaten deployment timelines: Lead times for larger DRAM orders have extended beyond 40 weeks, making many configurations unworkable for FY 2026 planning. Organizations face significant pipeline risks as server deployments slip into 2027.

Budget planning impacted by cyclical pricing: Early 2026 pricing will remain elevated due to Q4 2025 demand pull-forward, with softening expected in Q3 2026 as inventory builds and demand subsides. IT leaders must plan budgets carefully to avoid overpaying during peak periods.

How can you mitigate the business impact of shortages and price increases?

We recommend taking four actions today to optimize success in spite of the memory shortage:

Engage line of business leaders early: Collaborate with business units to identify workload priorities and map memory requirements accordingly to reduce the risk of over-purchasing and ensure alignment with organizational goals.

Optimize server configurations: Collaborate with IT architects to ensure server configurations align to validated DRAM modules. Avoid excessive memory densities that exacerbate lead-time risks.

Adopt phased deployment strategies: Split deployments into phases, prioritizing critical workloads early in the year while deferring non-critical systems to Q3 or Q4 when pricing stabilizes. Acquire servers in 2026 with half memory capacity and plan for memory increases in 2027 to better align with the memory consumption dynamics of a three-to-five-year lifecycle.

Leverage VMware licensing: VMware customers should align infrastructure plans with VMware’s emerging standard for five-year licensing agreements. IT teams can use new production-ready features, including memory tiering in VMware Cloud Foundation (VCF) 9.0, to reduce memory demand.

Supply chain dynamics: What are the root causes of the memory shortage?

AI-driven data center expansion is at the heart of the current memory shortage. Let’s explore how we got here:

Tier-1 manufacturers and wafer allocation

SK hynix, Micron, and Samsung control the majority of global DRAM production. These manufacturers (fabricators or ‘fabs’) produce memory wafers, which are cut into dies and either sold to independent module manufacturers (e.g., Kingston, ADATA, Axiom) or used internally to produce SDRAM products sold to server Original Design Manufacturers (ODMs), Original Equipment Manufacturers (OEMs), and hyperscalers. Wafer reallocation to AI workloads, particularly HBM3E and HBM4 for GPUs, has reduced the supply of traditional DRAM dies for server RDIMMs. SK hynix announced in October 2025 that it had secured demand for its entire 2026 RAM production, while Micron’s CEO Sanjay Mehrotra predicts supply “tightness continuing into 2027.”

Impact of AI demand and OpenAI’s influence

OpenAI’s public announcements in Q4 2025 to invest hundreds of billions of dollars in new hyperscale data center sites made it clear that AI infrastructure demand is accelerating. These plans come with unprecedented HBM and wafer demands, prompting hyperscalers to pull purchases forward and stockpile DRAM inventory amid fears that waiting would mean competing for constrained supply later.

OEM rationing and memory validation

Server OEMs face reduced allocations due to hyperscaler priority and are expected to restrict standalone memory purchases, with DIMMs being sold as part of complete server configurations.

Factors affecting pricing and availability

As we’ve noted, this situation is dynamic and influenced by a broad range of factors. These in turn are impacted by global geopolitical and macroeconomic factors. For this reason, scenario analysis is key to successfully navigating the shortage.

What might make it worse?

- Impact of Q4 2025 demand pull-forward: Hyperscaler stockpiling has created a backlog that Tier-1 fabs are unlikely to resolve quickly, as fabs continue prioritizing HBM production.

- Lead-time dynamics: Lead times extending from 25 weeks to 45+ weeks by December 2025 indicate that supply constraints will persist well into H1 2026.

- Supply chain rigidity: Wafer reallocation to HBM has structurally reduced DRAM availability for server RDIMMs. Even as hyperscaler demand eases, there will likely be lagging effects on pricing as fabs rebalance production.

- Elasticity of enterprise demand: While server memory demand is elastic (e.g., deferred purchases, hybrid architectures), deferred demand from H1 2026 will impact H2 2026.

- AI capex commitments: AI-driven demand for HBM will remain strong through 2026, siphoning wafer capacity from DDR5 production.

- Further allocation panic: The technology industry has historically run on fear, uncertainty, and doubt (FUD), so any further rumors of allocation issues may trigger further panic buying and stockpiling.

- New AI demand: With AI initiatives moving so fast, demand for resources is unpredictable. New developments may result in further demand by hyperscalers and AI companies for yet more memory.

What could make it better?

- Manufacturers block customers from hoarding memory: It has been reported that Samsung, SK hynix, and Micron are asking their customers for more information about demand and orders to minimize stockpiling and the resulting impact on availability.

- AI investment normalizes: Price increases cause AI workloads to cost more, delaying deployments, scaling back pilots, and prioritizing use cases with clear ROI. Demand for AI reduces and with it volume of memory inventory it consumes.

- New fab capacity comes online earlier than anticipated: Additional production lines increase supply and balance demand, reducing both lead times and prices.

- Business response to the shortage: As IT teams improve lifecycle management and redesign data center architectures to use memory more efficiently, demand will reduce — possibly permanently.

- Fatigue and budget exhaustion: As the money runs out and IT teams stretch to manage the situation, businesses are likely to delay or cancel projects.

NEXT STEPS

Review the various forecasts from analyst firms, OEMs, and in the trade press for pricing and availability on a regular basis and adjust your plans accordingly.

For more information on how SHI can work with you to mitigate the impact of the memory shortage on your organization, see our memory and storage shortage web page.